Trusted by Over 100 Brands

We Scale eCommerce Brands.

Faster, Smarter, Profitably.

Serious Growth Requires a Serious Partner. That’s Where We Come In.

Fuel your growth with the full-service agency built for scale. We craft high-converting campaigns that help 7, 8, and 9-figure brands reach their next level.

Challenges We Solve For

eCommerce brands face relentless change and increasingly complex challenges. Rozee Digital solves these issues at scale. We tackle:

- Rising Customer Acquisition Costs

- International Expansion & Scaling

- Full-Funnel Performance

- Growth Strategy & Scaling Profitably

- Declining Retention & LTV

- Standing Out in a Saturated Market

- New Customer Revenue Stagnation

- Struggling to Hit Profitability While Scaling

Helped Cocopup & Coconut Lane to profitably scale revenue by 25% & hit 7 figure month.

Learn how these brands went from struggling with unprofitable Facebook ads to driving scalable, profitable new customer growth with our paid social strategy.

Jess | Cocopup & Coconut Lane

Co-Founder

We helped Alp n Rock to profitably scale from $300k to $1million a month in 70 days.

Learn how Alp N Rock went from $300K to $1M monthly revenue with a 552% boost in new customer sales and a 22% increase in ROAS with our marketing specialists.

Steve | Alp N Rock

COO

Helped Hampden Clothing go from $4m to $12million at 10x ROAS.

Learn how Hampden Clothing went from $4M annual revenue to $12M with explosive multi-channel growth, driving new customer acquisition across Meta, Google, Pinterest, and email.

Katherine | Hampden Clothing

E-Commerce Director

Helped Sans Matin to double their revenue while increasing profit.

Learn how Sans Matin went from stagnant growth with their previous agency to doubling revenue and achieving consistent year-on-year increases through optimised Meta and Google Ads.

Lockie | Sans Matin

Co-Founder

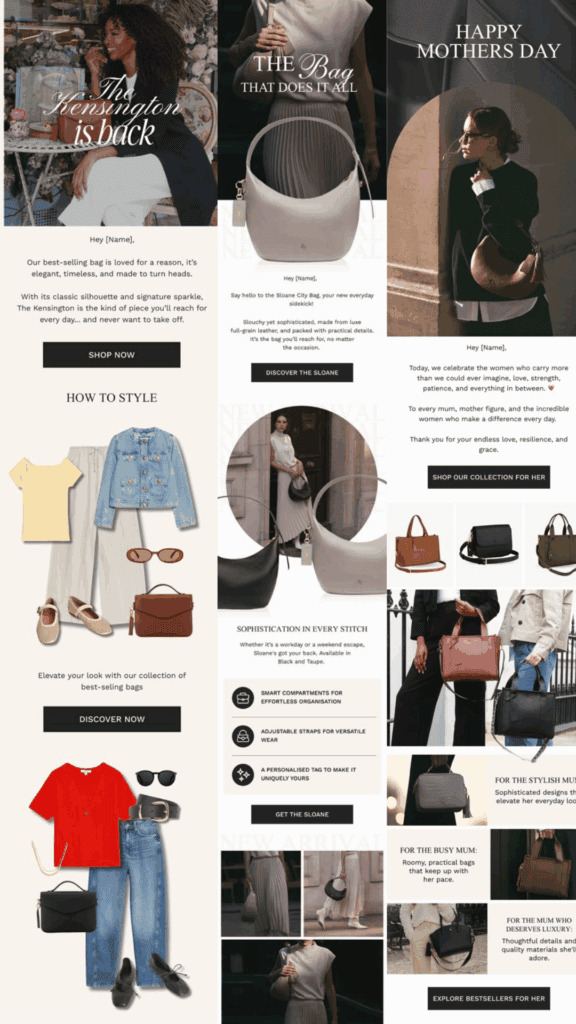

PERFORMANCE-DRIVEN CREATIVES

We turn your photos and videos into high-performing creatives, using proven hooks and headlines that drive conversions.

With a deep understanding of what works at every stage of the funnel, our tested templates speak directly to your audience.

We analyse the data, refine the strategy, and roll out creative variations that scale profitably.

SCALABLE paid ads strategy

Whether your brand’s goal is to attract more new customers, improve your return on ad spend, or scale to 7-figure months, we’ll tailor our strategy to meet your needs.

Guided by your targets, profit margins and historic performance, we set realistic KPIs that guide our decisions. Giving you that much needed visibility of the budget required, the target ads revenue and how this will support your overall growth.

email flows + campaigns

Don’t let your paid ads work overtime by not having your middle-of-funnel email marketing optimised.

Reduce your acquisition costs, boost revenue, improve lifetime value and nuture new customer connections with high-converting email flows & campaigns.

We can build flows to last a lifetime, or manage your weekly campaigns for consistent revenue.

Other Agencies vsRozee Digital

Old Agency

- Poor Communication

- Low ROAS One-Time Customers

- Generic Copy & Paste Content

- Waste Years of Potential Growth

- Burning Ad Spend in the Dark

- Copy paste growth strategies

Your New Agency

- Predictable New Loyal Customers

- 24/7 Accurate Data Insights

- Increase Retention and Cross-sell

- Unique Brand-Aligned Content

- Omni-channel approach

- Streamlined Fast Messaging

From Strategy to Scale.

Our Proven Process That Drives Results.

Rozee Digital takes a holistic and sustainable approach towards brand growth. This means focusing on all aspects including cutting acquisition costs, increasing customer lifetime value, and boosting profitability.

Accelerated Growth

Fast-track your growth as we hit the ground running by enhancing your audience targeting, messaging, creatives, and analytics.

Maximized Profit

From cutting costs to improving conversions and increasing customer value, our strategies are built to maximize your ROI.

Complete Transparency

Stay informed with clear reports and regular updates. We keep you in the loop, so you know exactly how your campaigns are performing.

More Time And Money

We handle your marketing, freeing up your time to focus on further expanding your business. It’s how you get to success faster.

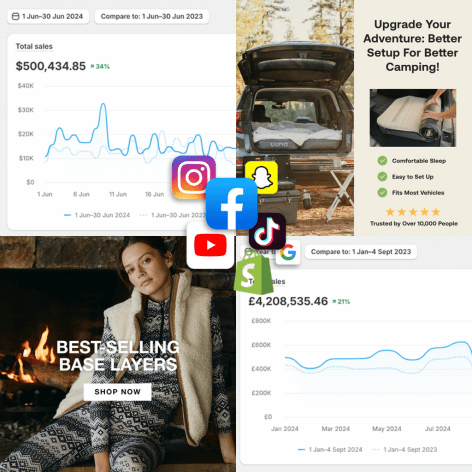

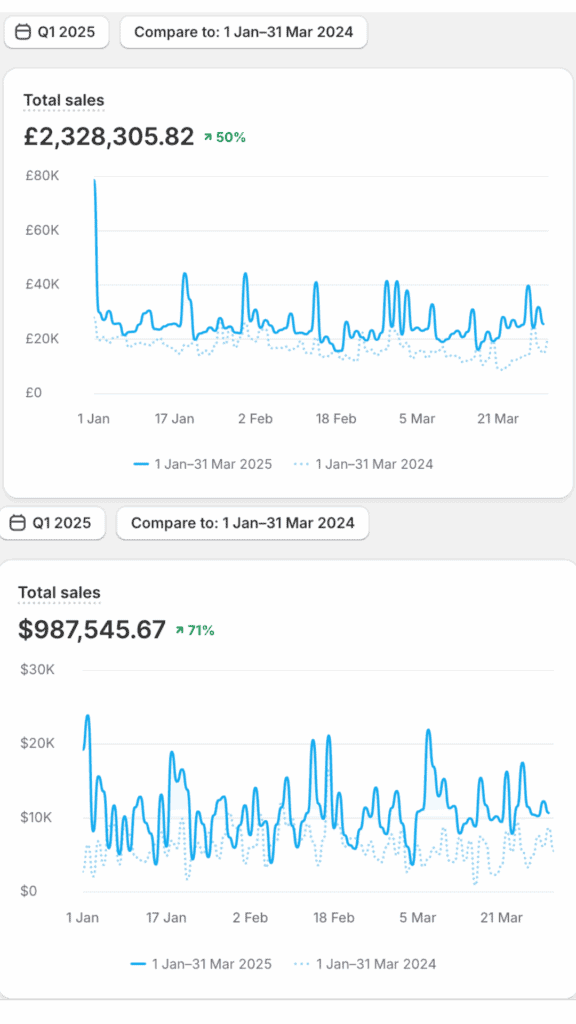

And We’ve Got The Numbers

to Prove It!

Our digital marketing services have scaled 100+ brands to 7, 8 and 9 figures. Discover success stories from companies just like you

Hampden

Went from $2.3 million to $12 million and 10X ROAS with our Google, Meta & Pinterest campaigns.

What’s It Like Working With Rozee Digital?

Long-Term, Sustainable Growth

We’re not just about short-term wins—we’re here to help you crush both your monthly and yearly goals. It’s what makes us one of London’s top-rated digital marketing agencies.

A Partnership You Can Trust

From day one, we’re in this together. With open communication, close collaboration, and consistent support, we provide a working relationship you can lean on.

From Strategy to Scale.

Our Proven Process That Drives Results.

1

Understand Your Goals

We start with a discovery call to learn about your goals and challenges. This helps us understand your expectations from our marketing service so we’re aligned from the get-go.

2

Perform Target Market Research

Next, we dive deep into your audience. We understand their pain points, behaviors, and preferences. This helps us craft campaigns that resonate with your ideal customer profile.

3

Design Customized Strategies

Next, we put together our research and your requirements to carefully design data-driven marketing strategies, tailored specifically for your brand.

4

Work With Close Collaboration

Expect open communication, regular updates, and a shared commitment to your brand’s growth every step of the way. We aren’t just a digital marketing service provider; we’re your partner.

5

Share Routine Reports On Progress

We always keep you in the know. Our detailed reports break down key metrics, campaign performance, and actionable insights, giving you clear visibility into results at all times.

Our Services

Customer Acquisition

Customer Retention

Consulting

How Soon Does The Money Roll In?

48-Hour Optimisation

From day one, we start fine-tuning your campaigns to find quick wins. We cut wasted spend, plug profit leaks, and find low-hanging fruit for your revenue.

30-Day Growth

Next, we optimise audience targeting, boost ad engagement, refine campaign messaging, and prioritize high-impact strategies to deliver sustainable growth.

Year-On-Year Success

In one year, we turn your brand into a revenue powerhouse. Our long-term strategies solidify your brand’s market position, beat the competition, and deliver consistent ROI. No surprises.

Continued Success With New Trends

The marketing landscape is forever evolving. That’s why Rozee Digital continuously optimizes your strategies so your business enjoys uninterrupted revenue growth.

Marketing Strategies Proven to Work

Working with UK’s leading brands has enabled us to build a repository of foolproof campaign ideas. We lean on this experience to power your growth and eliminate the guesswork.

Long-term Revenue Growth

Finally, this full-suite marketing framework lets us scale our brands sustainably. The growth starts early but stays with you throughout. It’s all the digital marketing help you need in one place.

We are not an agency…

We’re Not Just An Agency, We’re Part Of Your Team

Rozee Digital

Average Agency

Design

Rozee Digital: Design thorough and custom marketing strategies with detailed dashboards, covering ROI, ROAS, CAC, CLV, and more.

Average Agency: Rely solely on in-channel ROAS.

Deploy

Rozee Digital: Work on a month-to-month basis, confident in our ability to deliver results.

Average Agency: Lock you into 3-6 month contracts.

Develop

Rozee Digital: Performance-based deals, meaning our growth relies on your growth.

Average Agency: Long-term contracts with no guarantee of success.